Discovering the Advantages of Hard Money Borrowing in Today's Realty Market

In the present property landscape, Hard cash lending provides a pragmatic solution for investors. Its fast funding abilities enable fast decision-making, which is significantly critical in a hectic market. Additionally, the adaptable car loan terms provide to a range of investment approaches, improving ease of access. As even more investors transform to these options, understanding the more comprehensive ramifications of Hard money providing ends up being crucial for steering today's financial opportunities. What exists ahead for capitalists accepting this strategy?

Understanding Hard Money Loaning

Speed and Performance of Funding

Difficult money loaning is particularly valued for its speed and efficiency in funding, making it an attractive choice for actual estate investors who need quick resources. Traditional financing usually includes extensive authorization procedures and comprehensive documents, which can delay deals. On the other hand, Hard money loan providers concentrate primarily on the property's value instead than the borrower's creditworthiness, permitting faster authorizations and analyses. Usually, investors can protect financing within days instead than weeks, allowing them to confiscate time-sensitive possibilities, such as distressed residential or commercial properties or competitive bidding process scenarios. This quick access to funding can be a game-changer in a vibrant actual estate market, where timing is important for making best use of returns and achieving investment goals. Rate and performance become significant benefits of Hard cash loaning.

Flexibility in Loan Terms

Conquering Credit Report Obstacles

In the domain name of Hard money loaning, getting over credit scores difficulties is typically made viable via adaptable credentials requirements. This strategy allows borrowers with less-than-perfect credit rating to access funding possibilities that typical lending institutions may refute. Additionally, the promise of quick funding solutions can greatly expedite the financing procedure, resolving immediate realty demands.

Versatile Certification Requirements

While standard loaning commonly rests on stringent debt ratings and substantial documentation, Hard cash providing provides a more fitting method to qualification criteria. This flexibility permits debtors with less-than-perfect credit histories or one-of-a-kind monetary scenarios to safeguard funding. Lenders largely concentrate on the worth of the realty security instead of the borrower's credit history, making it much easier for capitalists to gain access to resources quickly. This can be specifically useful for those looking to take financial investment opportunities or browse tough economic landscapes. Additionally, the structured application process lowers the problem of extensive documents, making it a viable alternative for many that might or else struggle to qualify with standard methods. Hard money providing offers as a practical choice for getting rid of debt challenges.

Quick Financing Solutions

Several investors encountering credit history obstacles locate themselves in urgent need of quick funding remedies, and Hard cash offering provides a timely avenue for acquiring needed funding. Unlike traditional loan providers, Hard cash loan providers focus on the worth of the residential or commercial property over the customer's credit history, permitting those with less-than-perfect credit to secure financing. This approach is especially helpful genuine estate capitalists seeking to profit from time-sensitive opportunities, such as foreclosure public auctions or affordable residential property sales. The streamlined application process and quick approval timeline make it possible for financiers to gain access to funds swiftly, commonly within days. By assisting in quick transactions, Hard cash lending encourages financiers to overcome credit rating barriers and confiscate profitable real why not find out more estate ventures without the delays usually associated with standard financing approaches.

Opportunities for Real Estate Investors

Opportunities are plentiful for actual estate financiers seeking to utilize Hard cash providing as a strategic click site funding option. This alternate funding source supplies quick access to capital, allowing investors to take time-sensitive offers that typical financing might not fit. Hard money Loans are generally based on the residential property's value instead than the consumer's credit rating, making them obtainable for those with less-than-perfect credit scores. Furthermore, these Loans offer versatile terms, permitting investors to customize funding solutions to their certain needs. By using Hard money financing, capitalists can go after numerous property ventures, from fix-and-flip tasks to rental building acquisitions, thus expanding their profiles and making the most of prospective returns in an affordable market.

The Duty of Hard Money Lenders in the marketplace

Hard cash loan providers play an essential duty in the genuine estate market by supplying fast accessibility to resources for investors. Their flexible finance terms deal with a variety of financing demands, enabling debtors to confiscate possibilities that standard loan providers might ignore. This versatility makes Hard money offering a necessary element for those looking to broaden and innovate in the genuine estate sector.

Quick Access to Resources

While standard funding techniques can be time-consuming and difficult, Hard money lending institutions use a streamlined service genuine estate capitalists seeking fast accessibility to funding. These lenders focus on rate and effectiveness, enabling borrowers to safeguard funds within days instead of weeks or months. This immediacy is specifically advantageous in affordable realty markets, where timing can be essential for acquiring residential or commercial properties prior to they are sold to other investors. Hard cash Loans are commonly based on the worth of the security rather than the consumer's creditworthiness, allowing financiers with less-than-perfect credit rating to accessibility funds. Therefore, Hard money loaning has emerged as an essential source for those looking to maximize prompt investment chances in the vibrant property landscape.

Adaptable Finance Terms

The agility of Hard money offering not only gives fast access to funding however likewise uses adaptable lending terms that satisfy the diverse needs of investor. Unlike conventional funding, Hard money loan providers often permit tailored repayment schedules, passion prices, and lending durations, suiting numerous investment techniques. This versatility makes it possible for financiers to straighten their financing with their job timelines and capital scenarios. In addition, Hard money Loans can be structured to meet particular property types and investment goals, boosting the total usefulness of property endeavors. By using such customized choices, Hard money lenders empower investors to seize opportunities quickly and strategically, making them indispensable gamers in the present property market landscape.

Often Asked Questions

What Sorts Of Properties Receive Hard Cash Loans?

The sorts of residential or commercial properties that commonly receive Hard money Loans consist of residential homes, commercial property, fix-and-flip residential or commercial properties, land, and web investment residential or commercial properties. Lenders assess the residential property's worth and possible earnings rather than the consumer's credit reliability.

Are Hard Money Loans Managed by Federal Regulations?

Hard money Loans are not largely managed by federal regulations; instead, they fall under state policies. This absence of uniformity allows lending institutions to establish their very own terms, which can vary considerably across different jurisdictions.

Just How Are Rates Of Interest Figured Out for Hard Money Loans?

Rate of interest for Hard money Loans are usually identified by aspects such as the consumer's credit reliability, property worth, loan-to-value ratio, and market problems - Direct Hard Money Lenders. Lenders evaluate danger and readjust rates as necessary to guarantee earnings

Can Hard Cash Loans Be Made Use Of for Residential Qualities?

Tough cash Loans can undoubtedly be made use of for properties. Capitalists often look for these Loans for fast funding, specifically when standard Loans are not possible, permitting for speedy procurements and remodellings of domestic property.

What Happens if I Default on a Hard Money Financing?

If a debtor defaults on a tough cash finance, the lender might start repossession procedures. This procedure allows the loan provider to recover the home, typically causing the loss of the consumer's financial investment and equity.

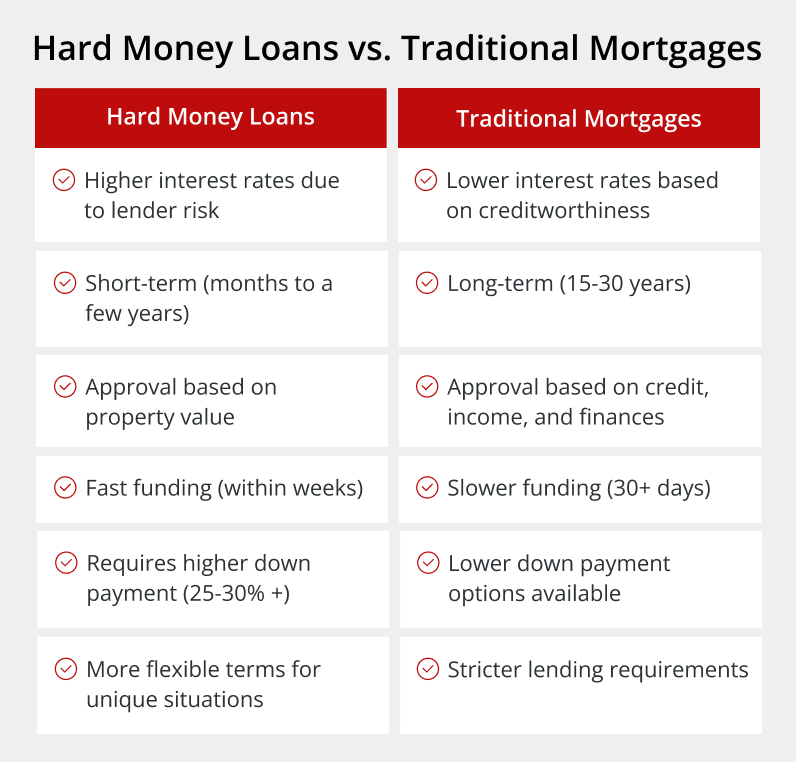

While conventional funding choices might provide lower rate of interest rates, Hard cash providing serves as a sensible choice for genuine estate investors looking for fast access to resources. Direct Hard Money Lenders. What makes Hard cash providing an attractive choice for several genuine estate investors is the adaptability it uses in loan terms. Opportunities are plentiful for genuine estate investors looking for to take advantage of Hard cash providing as a tactical funding choice. While conventional financing techniques can be troublesome and taxing, Hard money loan providers provide a structured option for actual estate financiers looking for quick access to resources. The agility of Hard cash lending not just gives quick accessibility to capital however additionally offers versatile car loan terms that provide to the diverse demands of actual estate financiers